ELECTRIC, WITH AN EDGE

Crypto is mined by mining machines. These mining machines generally use the computing power brought by the graphics card, and the other is to consume a lot of electricity. Choosing the right transformer is the good way to save your money . it can can favorably support your Bitcoin Mining power.

According to the size of the crypto farm, you can choose 750kva transformer, 1250kva transformer, 1600kva transformer, 2000kva transformer, 3500kva transformer, 3750kva transformer, 5000 kva transformer

According to the type of transformer, the main types of transformers that conform to the crypto farm are pad mounted transformer and mini substation transformer.

Daelim can provide you with the most suitable transformer for your crypto farm. According to your specific situation, we will provide you with the most professional crypto farm transformer solution. Currently in the United States and Canada and other regions, daelim has provided professional transformers for more than 30 crypto farms. Improve the efficiency of electricity use for customers and reduce power loss.

Blockchain is a new application model of computer technology such as distributed data storage, point-to-point transmission, consensus mechanism, encryption algorithm, etc., of which Bitcoin is an important concept.

Bitcoin mining is a mathematical operation for the Bitcoin network through computer hardware.

In the process, Bitcoin mining starts with low-cost hardware such as CPU or GPU. By optimizing the operation of the hash algorithm, it seizes the right to account for data blocks and obtains Bitcoin rewards.

The digital currency represented by Bitcoin is actually the product of the “hard work” of the mining machine’s computing power under the support of electricity.

Bitcoin is a decentralized Crypto that integrates existing computer network technologies such as encrypted computing, consensus mechanism, point-to-point transmission, and distributed data storage.

On this basis, the proof of work is used to perfectly overcome the Byzantine problem of the decentralized system.

After the emergence of Bitcoin, blockchain technology was widely defined as the underlying technology of Bitcoin.

It can be said that blockchain technology was born out of bitcoin, and while the bitcoin market and even the global Crypto market have suffered setbacks recently, blockchain technology is still the object of discussion among major research institutions.

Its applications continue to expand, from initially only used for the operation of cryptocurrencies, to later Internet of Things, social communication, file storage, supply chain finance, e-commerce, logistics tracking, identity verification, securities trading, equity crowdfunding, smart contracts, etc. multiple fields.

The Bitcoin system uses blockchain as the underlying technology, and builds a distributed general ledger network through P2P technology; ensures the security of transactions through computer encryption and network signature technology;

And solves the Byzantine problem of decentralized networks through workload proof.

At the same time, due to the sharp fluctuations in the value of Bitcoin, there are few payment scenarios for commodity purchases, and there is a lack of regulation and supervision and is excluded from the definition of currency by most scholars.

The main characteristics of the Bitcoin system boil down to: anonymity, openness, autonomy, decentralization and information immutability.

Decentralization means that there is no centralized organization with complete information and absolute authority as a manager, and all operations are carried out in a mutually trusted network environment.

Openness means that the Bitcoin system is open to any individual or institution.

Users can generate a public key, that is, an account, and hold a corresponding private key, that is, a password to initiate a transaction.

Users can also access all distributions at any time. data in the general ledger.

Bitcoin autonomy means that the blockchain adopts a consensus protocol, such as the use of the same hash algorithm and the use of the same new block verification rules.

This set of pre-designed protocols makes users trust each other in transactions.

This translates into trust in network programs.

Anonymity means that Crypto users only need to show their public key to accept transfers and use the private key to open transactions during transaction activities.

The use of public keys and private keys is similar to the use of accounts and passwords in the banking system.

Neither party knows the true identity of the opponent and only faces the public key represented by a string of characters.

The non-tampering feature of information stems from the large and decentralized distributed ledger system of the blockchain.

When a new block that records the latest transaction is connected to the main chain, the workload proof, timestamp, and signature of the miner node will be attached, and it has been connected to the main chain.

The original blocks of the chain cannot be tampered with and are mutually verified between each node.

Unless more than 50% of the nodes can be controlled at the same time, an attacker trying to tamper with the existing ledger is futile.

There are also many defects in the Bitcoin network.

First, the Bitcoin distributed ledger always faces a “51% computing power attack”;

Second, the proof-of-work used in Bitcoin mining can easily cause a lot of energy waste;

Third, the transaction throughput of the Bitcoin system is limited, and the transaction confirmation time is too long;

Fourth, the price of Bitcoin fluctuates violently, and it is easily affected by external factors to generate bubbles.

Cryptocurrencies such as Bitcoin are circulated in global markets.

But central banks around the world have different policies towards it.

Next, I will tell you in detail about the policies of various regions on cryptocurrencies, and provide a reference for the location of your encrypted mining farms.

| Nation | Cryptocurrency trading | Cryptocurrency ICOs | Are there regulations |

| China | prohibit | prohibit | no |

| Japan | allow | allow | Yes |

| South Korea | prohibit | prohibit | Yes |

| Thailand | Supervision | Supervision | Yes |

| Singapore | undecided | undecided | Yes |

| India | value | prohibit | Yes |

| Iran | value | undecided | no |

| USA | undecided | undecided | no |

| Israel | undecided | undecided | no |

| Australia | Supervision | Supervision | Yes |

| new Zealand | undecided | undecided | Yes |

| UK | undecided | undecided | no |

| France | undecided | Supervision | Yes |

| Germany | undecided | undecided | no |

| Russia | Supervision | Supervision | Yes |

| Switzerland | undecided | undecided | no |

| Italy | undecided | undecided | Yes |

| Spain | undecided | undecided | no |

| America | Supervision | Supervision | no |

| Canada | Supervision | undecided | no |

| Mexico | undecided | prohibit | Yes |

| Brazil | undecided | undecided | no |

| Chile | prohibit | undecided | no |

At present, Bitcoin is prohibited from trading and mining in China. On September 4, 2017, seven ministries including the People’s Bank of China jointly issued the “Announcement on Preventing the Risk of Token Issuance and Financing”, which pointed out that a large number of ICOs (the first generation of Token issuance) activities are suspected of being illegal, which seriously disrupted the economic and financial order, requiring that all kinds of token issuance activities should be stopped immediately, and China’s digital currency exchanges were also ordered to shut down.

Japan has the most friendly attitude towards bitcoin transactions. Japan recognized the legal status of Crypto in the country in the revision of the Funds Settlement Act implemented in April 2017, and implemented listing operations for exchanges. Digital currency trading operations need to hold License granted by the government. At present, there are 16 Japanese exchanges that have obtained legal licenses. According to regulations, these exchanges must pay certain tax items according to their operating profits.

Trading Bitcoin in South Korea requires a license, and exchanges are regulated like banks. According to South Korean law, ICO financing is illegal, but South Korea has not implemented specific rules, nor has it cleared domestic ICO platforms, and domestic investors can still participate ICO projects and digital currency exchange operations have not been affected.

South Korea’s crypto regulations are tightening around investors and exchanges alike

Crypto trading is a gray area in Singapore. On May 24, 2018, the Monetary Authority of Singapore (MAS) issued a written warning to 8 digital currency exchanges, prohibiting them from trading electronic securities in the form of securities or futures contracts without permission. Token. The new move by the HKMA is to protect Crypto investors by strengthening the supervision of exchanges, and guide the Crypto market towards formal legalization.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The central bank of India has banned banks from providing services related to Crypto business. On September 12, 2018, the central bank of India (RBI) submitted an affidavit to the Supreme Court of India. In the affidavit, the central bank of India clarified its position on digital currency, According to the current legal system, Bitcoin and its ilk cannot be recognized.

India might tighten crypto rules instead of imposing an outright ban, crypto exchange boss says

The European Commission has been discussing the details of the regulation. The European Securities and Markets Authority, which is tasked with coordinating regulatory standards across member states, suggested that individual investors should be banned from trading in financial derivatives involving cryptocurrencies.

The other side is also evaluating how the EU’s new regulation, the Markets in Financial Instruments Directive, will apply to virtual assets.

New regulations will also be enacted, restricting the use of sovereign currencies for platforms that conduct Crypto transactions to verify customer identities.

The European Securities and Markets Authority (ESMA) also recently issued an announcement strengthening the CFD regulations for virtual currencies.

The EU has also recently introduced the Anti-Money Laundering Regulation (AML) for cryptocurrencies, which is the fifth anti-money laundering regulation implemented by the EU to detect, investigate and prevent financial crimes in this area. ) to obtain digital currency wallet information and record the owner of the Crypto address.

Although the UK has not yet made a clear statement on regulating cryptocurrencies, it has been actively promoting the implementation of regulation. In April 2018, the UK Financial Conduct Authority FCA announced that companies providing services related to Crypto derivatives must comply with all relevant regulations in the FCA manual, otherwise they will face enforcement measures. Therefore, trading activities related to the issuance of tokens through ICO and the provision of advice or other services require the FCA’s review authorization, including Crypto options, Crypto futures and Crypto CFD contracts.

Digital currency trading in Germany is allowed but requires a listing. German regulators want a case-by-case approach to cryptocurrencies. Review ICO token offerings on a case-by-case basis to determine what legal framework applies. The current German federal agency advises the relevant authorities to refer to the regulations applicable to traditional financial instruments and to comply with the current legal regulations.

French regulators said that crypto-related derivatives online service platforms need to follow more stringent reporting mechanisms and business guidelines. The French government has decided to treat virtual currency as “liquid assets” and reduce the tax rate for individual traders of virtual currency. This measure reduces the loss of income for individual traders by 50%, while the tax point for virtual currency companies has not been lowered. In terms of ICO regulation, the French financial market regulator AMF announced that it is preparing to introduce legislation on ICOs to encourage new types of financing activities in the country.

France Tightens Cryptocurrency Regulations as of June 2021. Here’s Our Guide to Staying Compliant

The Swiss Financial Market Supervisory Authority (FINMA) published ICO guidelines in February 2018, which were developed to increase transparency for ICOs. The regulator has announced that it will review ongoing ICOs in the country for compliance with published ICO regulations. It is unclear whether FINMA will be inclined to take that action against violating platforms.

Russia’s Federal Financial Monitoring Service (FFMS) claims that Crypto trading platforms must comply with the provisions of the Russian Federation’s laws on anti-terrorist and anti-money laundering financing, otherwise their business licenses will be cancelled. Although Russia announced a complete ban on bitcoin in February 2014, the Russian Federal Tax Service declared bitcoin “not illegal” in November 2016.

Russian Federation: New Bill Defines Cryptocurrency, Proposes Tax Regulations

While U.S. states have different regulations on cryptocurrencies, they have generally become stricter in recent years. The U.S. Commodity Futures Trading Commission (CFTC) regards bitcoin as a commodity, and claims that its regulatory objects include manipulation and fraud involving bitcoin in intercontinental trade, as well as commodity futures transactions directly linked to bitcoin.

The Canadian government issued new draft regulations for digital currency exchanges and payment processing providers in June 2017. The draft treats digital currency exchanges and payment processing providers as money services business lines (MSBs), requiring them to report large-value transactions over C$10,000 ($7,700).

Blockchain & Cryptocurrency Laws and Regulations 2022 | Canada

Australia does not explicitly ban Crypto exchanges and ICOs, but its officials say it will impose stricter regulations on ICOs. The country’s regulator said it would highlight a ban on ICOs that mislead or deceive investors.

Blockchain & Cryptocurrency Laws and Regulations 2022 | Australia

There are two factors that affect the price of Bitcoin.

External reasons: economic scale, bank interest rates, electricity prices, capital inflows.

Internal reasons: transaction volume, power consumption, transaction fees.

Internal reasons directly affect the computing power of Bitcoin mining farms. The computing power of Bitcoin mining farms directly affects the price of Bitcoin.

Halvor Aarhus Aalborga, Peter Molnára, and Jon Erik de Vries (2018) found that a heterogeneous autoregressive model is suitable for Bitcoin price prediction, and the transaction volume of Bitcoin can be estimated from the “bitcoin” search volume data of the Google system.

Michal Polasik and Anna Iwona Piotrowska also pointed out that Bitcoin price performance is directly proportional to the media popularity of related topics, and they also pointed out that Bitcoin has a very broad prospect in the e-commerce payment scene.

Ladislav Kristoufek’s (2015) work covers a wider range. He conducts a wavelet coherent analysis on the price of Bitcoin from multiple perspectives such as the operation of traditional financial assets, Bitcoin’s technical characteristics and public attention, and finds that Bitcoin has traditional gold prices in the long run The attributes of assets are more affected by public attention in the short term.

Pavel Ciaiana and Miroslava Rajcaniova (2015) and others used the currency analysis model proposed by Barro (1975) to analyze the components of currency prices from two aspects: traditional market power and Bitcoin’s short-term attractiveness to investors. Investors’ short-term behavior has also significantly pushed up the price of Bitcoin.

Dirk G. Bau and Thomas Dimpflb (2018) compared the yield fluctuation parameters of Bitcoin, gold and the US dollar through empirical analysis based on the GARCH model, and found that Bitcoin is neither like the US dollar nor gold, and has a new yield characteristic and volatility characteristics.

Bitcoin mining is the only way for new bitcoins to be issued. The process of mining activities is as follows:

(1) Each miner node calculates its hash solution (Hash) with the content of the latest block in the local blockchain as the input value;

(2) Bitcoin miners screen the transaction information forwarded or published by other nodes, delete the transaction information that has been included in the blockchain, have insufficient balance or have other errors, and also continuously broadcast the recorded information to the outside world. trade;

(3) Randomly generate a set of strings, by combining the string with the previously obtained hash value and the entered transaction information as input, the output generates a new hash value;

(4) Check whether the new hash value is less than the current difficulty threshold. If so, the mining is successful, and a new block is generated and broadcast to the whole network. If the hash value is greater than the threshold, restart from step 3. calculate.

(5) Other nodes receive the newly born block and verify whether its hash value meets the requirements. If enough miner nodes prove that the block is uniquely valid, other nodes will receive the block and add it to the block. added to the local blockchain. Miners who successfully mine new blocks will be rewarded with a certain amount of Bitcoin, and the Bitcoin system will generate a new block in about ten minutes on average.

(6) If other miner nodes successfully mine a new legal block, the remaining nodes will add this block to the local, and then start mining again from step 1.

In order to effectively control the fast production speed of the new area, the Bitcoin system continuously adjusts the difficulty threshold of the hash algorithm according to the total computing power of the entire network. The larger the computing power of the entire network, the smaller the threshold and the higher the difficulty.

When the time interval when a new block is mined is less than 10 minutes, the system will automatically increase the difficulty of the hash algorithm of the next block, and when the time interval when a new block is mined is greater than 10 minutes, the system will reduce the difficulty of the next hash algorithm. Eventually, a new area is generated on average every 10 minutes.

That is to say, the average computing power put into production in a period of time is directly proportional to the mining difficulty. The higher the computing power of the entire network, the greater the mining difficulty. Miners participate in the competition of the entire network with their own computing power, and mine according to the probability determined by the ratio of their computing power to the computing power of the entire network. If the hash value of the previous block is successfully calculated first, it will be announced to the network. , and is recognized by the entire node network, then it can be counted as successful mining.

If someone mines ahead of time within ten minutes, the previous operation will be invalid and a new block can be created.

The working method of paying computing power to solve the hash problem used in Bitcoin mining, also known as proof-of-work (proof-of-work), this mining method is accompanied by extremely high power consumption, power consumption and representative The bitcoin price of miners’ income is proportional to the price.

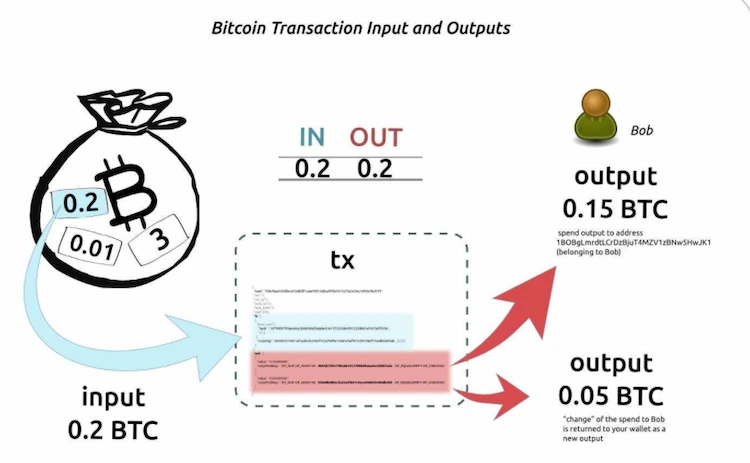

The process when a bitcoin transaction is transferred from originator A to recipient B is as follows:

(1) A broadcasts the number of bitcoins plus its own private key and recipient B’s public key to the network as transaction information;

(2) If this transaction information occurs for the first time and the A account balance is sufficient, it will be verified and forwarded by the network node;

(3) When a new block is successfully mined by a node, the transaction information between A and B verified by the node will be permanently recorded in the new block;

(4) If the transaction information is not included in the new block in time, it will continue to be broadcast between nodes until it is included in a block;

(5) Receiver B can trace and verify the transaction at any time as long as he holds his own public key.

The public key and private key of each participant in a bitcoin transaction are like the account and password of each user in the banking system.

The public key represents the identity, and the private key is the payment password.

This ensures the anonymity of Bitcoin transactions – the identity information of the trader is only a public key composed of a string of codes, and they cannot know each other’s true identity; it also facilitates authorized law enforcement and regulators – If the law is enforced, law enforcement can use high-end network technology to track all transactions, so that all bitcoin movements can be found and the corresponding users can be found.

According to Digiconomist’s “Bitcoin Energy Consumption Index,” as of November 20, 2017, Bitcoin’s current annual electricity consumption was estimated at 29.05 terawatt-hours, equivalent to 0.13% of total global electricity consumption.

Bitcoin mining will consume all the electricity in the world by February 2020;

Global annual mining revenue is estimated at $7.2 billion.

According to the latest report from Wall Street News, China’s computing power has accounted for more than 75% of the world’s computing power, which means that 75% of the world’s bitcoins are made in China.

However, due to changes in the Chinese government’s environmental protection policies, by 2022, all Bitcoin mining areas in China have been closed. A large number of Bitcoin mining farms moved to North America and Eastern Europe.

A mining farm is a place that consumes a lot of electricity, and a large mining farm is usually composed of thousands of mining machines.

The computing power and energy consumption of the mining machine, for example, take the Ant T9+ mining machine with low power consumption on the market, the computing power is 10.5TH/s, and the power consumption is 1400w. The mining machine runs 24 hours a day. in the case of:

1.4 kW*24=33.6 kWh Bitcoin mining machine needs to run continuously for 24 hours, and the power consumption of a single machine is very large in one year.

The cost of the ladder price of household electricity is too high, and when the market is not good, the income may not even be enough to pay for the electricity bill.

Therefore, at present, mining will choose to be hosted in the mine, which can get cheap electricity, reduce the cost of mining, and maintain a reliable and stable power supply to maintain the continuous output of Bitcoin.

As far as the current Bitcoin mining difficulty is concerned: Bitcoin (BTC) income per T: 1TH/S*24H=0.00007087BTC, and the daily output calculated based on the combined computing power of 10.5T is: 0.00007087*10.5t=0.000744135BTC ;

Then the time required for a single machine to mine one BTC is: 1/0.000744135=1343 days, and the power consumption cost of each BTC is 45153 kWh. According to the calculation of usd 0.078 per kilowatt-hour of electricity, the electricity cost of each bitcoin is about usd 3521. Plus the cost of a single T9+ machine is about usd 1260.

5,000 machines are invested at one time, 40 million hardware is invested, and the power consumption is 168,000 kWh per day. According to the current BTC price of usd 8,667/unit, 1,359 units are produced in a year, the output value is usd 11.78 million yuan, and the power consumption is 61.32 million kWh. Equipment cost, the annual net profit is USD 5.23 million.

The pad mounted transformer is a complete set of power distribution device which is a combination of high voltage switchgear, power transformer and low voltage switchgear, power factor compensation device and electricity metering device.

It has the advantages of reducing comprehensive investment (such as civil construction), reducing maintenance costs, small footprint, and short on-site installation time.

The pad mounted transformer means that the equipment of the substation is installed in a container with the appearance of a “box”, with no walls, no houses, no cables, no structure, and the construction of the substation is factory-like.

Pad-mounted transformer is a unified design of transformer core, high-voltage load switch, protective fuse, and other equipment, placed in the same oil-filled iron box, so the volume is small.

In the construction of crypto farms, pad-mounted transformers are widely used, which not only reduces engineering investment and floor space but also shortens construction period and maintenance costs.

After the pad-mounted transformer is put into operation, the operation is safe, the reliability is high, and the maintenance is particularly convenient.

Because the pad-mounted transformer is a piece of primary equipment, the selected models are maintenance-free products and do not need periodic overhauls, which enhances the reliability of the power supply to a certain extent and greatly reduces external power outages and equipment maintenance costs.

Because the pad-mounted transformer is designed to be unattended, it has the function of “four remotes”, remote monitoring operations are adopted for power off and power transmission, and it has the function of microcomputer locking device, etc., which can avoid equipment misoperation accidents to the greatest extent, so it is used in crypto farms. widely used.

(1) Small size and compact structure;

(2) Fully sealed and fully insulated structure, no insulation distance is required, and personal safety is reliably protected;

(3) It can be used for both the ring network and the terminal, the conversion is very convenient, and the reliability of the power supply is improved;

(4) Strong overload capacity;

(5) Small loss;

(6) The cable connector can operate a load current of 200A, and can be operated as a load switch in emergency situations, and has the characteristics of an isolation switch, which is convenient and flexible to operate;

(7) Double fuse protection is adopted to reduce operating costs;

(8) Use high flash point oil (fire point up to 312°C), which can be placed in buildings;

(9) The box body adopts anti-corrosion design and special painting treatment, which can be widely used in various harsh environments, such as stormy and highly polluted areas.

ELECTRIC, WITH AN ENGE-- DAELIM BELEFIC

After filling in the contact information, you can download the PDF.